|

Plastics ban, worker strike: Challenges for Indian PE marketPlastics ban, worker strike: Challenges for Indian PE market |

|

On 23 March 2018, the Indian government announced the ban on the manufacturing, using, selling, distributing and storing of plastics materials including single-use plastic bags, plastic bottle, plastic cutlery and thermocol items. Companies in 25 states were given three months to dispose of the existing stock, which ended on 23 June 2018.

According to the Plastic Bags Manufacturers Association of India, the ban resulted in a loss of INR 150 billion ($2.2 billion) for the plastic industry and wipe out 300,000 jobs overnight. Nearly 2,500 members have to shut down businesses following the ban, the Association added.

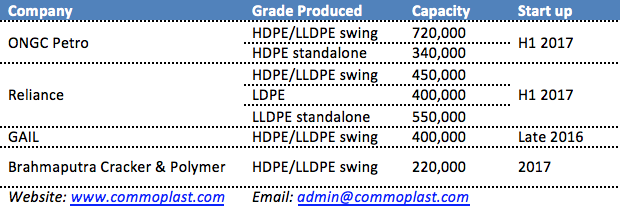

“Demand for PE dropped significantly. This is not a good development considering a number of new PE plants come online over the past year,” a local producer said.

With these new start-ups, India has been forecasted to turn into net exporter for PE even before the plastic ban that tapers domestic demand. “We are looking to reduce the impact on our production and so far, export is one of the most established solutions,” another producer added.

Indian producers have been actively exploiting demand in near-by Southeast Asia and China market over the past several months, and in the near-term, buyers shall expect more regularly in-flow of Indian materials.

“Besides, we are discussing with the government regarding other solutions to the pollution issues including ways to improve waste collection and recycling, while reducing the impact of the recent ban on the plastic industry. However, this might take time,” another market source added.

While the medium and long-term prospect of the PE sector darkens by the plastic ban, the near-term market outlook is clouded, too, amid the countrywide trucker strike, which has been going on for a week now. The All India Motor Transport Congress (AIMTC) is leading a protest against the rising fuel costs, and the high cost of the goods and service tax (GST) imposed last year. Delivery not only for PE parcels, but many other goods are technical disrupted.

“It is a chaos at our facility now,” a converter informed. “There is not enough space to store manufactured goods while raw material stocks are running low,” the source added.

There are rumours that the combined effect from the two events has forced at least one producer in the country to shut down plant. “It is the monsoon season and therefore, we can’t keep the inventories in an open area. If the strike continues to take place, shipment to overseas customers would also be affected,” a local producer added.