|

Indian multilayer packaging next in line under plastic ban, local producers push for exportIndian multilayer packaging next in line under plastic ban, local producers push for export |

|

The Indian government has put into practice a stringent plastic ban on 23 June as part of the country’s plan to completely eliminate the use of single-use plastic in India by 2022.

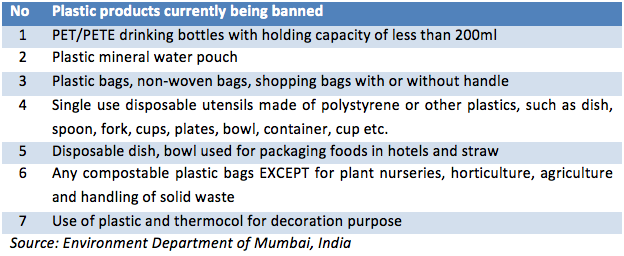

The following table extracted information from a guidebook for plastic and thermocol ban circulated by the Department of Environment, Government of Maharashtra, India.

At the moment, it appears that HDPE film sector get the strongest hit from the recent ban and a number of traders contacted by CommoPlast reported having drop PE business significantly since the circular came into effect.

However, this is not the end. The Indian government has given multilayer packaging companies three months to innovate or face similar elimination, according to media reports. Targeted products including multi-layered or laminated plastic pouches and tetra-packs that used in the packaging of chips, chocolate and juice pouches.

“These companies have three months to come out with more eco-friendly alternatives while an extended producers’ responsibility to collect and recycle these products must be in place. Costs are at the high side,” a market source said.

In multilayer packaging, the aluminium and paper layers are biodegradable and manufacturers are struggling to convert the plastic layer to the same kind in the most cost-effective manner.

Looking at this trend, one might assume that biodegradable business could be a big trend in India, and yet, the insiders do not think so. “The biggest sector is the plastic bags and it has been banned, consumption in other sector is not big enough to create a boom,” a source added.

Indian PE producers have been expressing the intention to focus on export market in the near term as domestic demand is witnessing a dramatic reduction. “We continue to hold talks with the related authorities on ways to reduce the impact on the industry,” a producer said.

India brought on stream more than 3 million tons per annum of new PE capacity in 2017 with the primary focus on domestic demand.