|

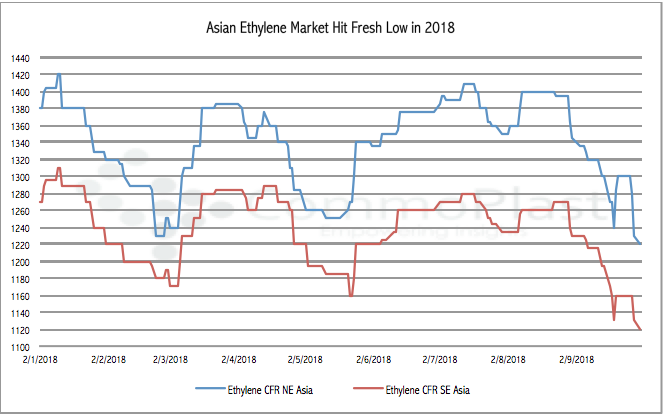

Asian ethylene costs hit fresh low in 2018 on weak demand, improved supplyAsian ethylene costs hit fresh low in 2018 on weak demand, improved supply |

|

The Asian ethylene market hit the fresh low in 2018 this week in the absence of Chinese buyers while supply seems improving as a result of the widely present of spot cargoes.

The downstream PE market has been performing poorly over the past months. At the time this report is published, import HDPE film to Southeast Asia stands at $1240-1280/ton and LLDPE film at $1110-1140/ton, both are well below the theoretical costs at the current ethylene prices.

Many integrated plants decided to either stop running LLDPE film totally or lower operation rate to reduce the losses. “This has resulted in excess ethylene supply, which producer tend to offer to the spot market,” a source commented.

Industry participants reported the availability of an open tender for 20,000 tons ethylene originated from Taiwan and 5,000 tons from Thailand in Northeast Asia at the moment. Buyers are placing bids at $50-70/ton lower than the current price levels.

Market might remains slow in the near term in the absence of Chinese buyers. Besides, the influx of deep-sea cargoes from the Middle East and the USA might put additional pressure on the market.