Asian players: LLDPE plants shutdown might tighten supply in August

Asian players: LLDPE plants shutdown might tighten supply in August

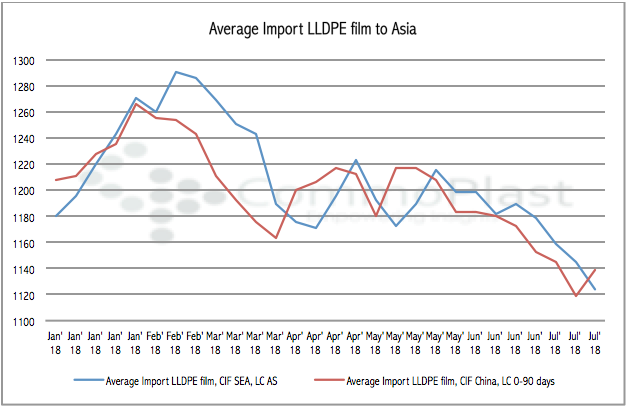

The import LLDPE film market in Asia has been falling since May tracking the drop in demand and comfortable supply condition. While import LLDPE film to China rebounded slightly since the second week of July, the Southeast Asia region is still struggling to find the bottom.

Such condition might not persist for long, market sources said, as supply might curtail in the near-term with a number of major plants facing production disruption, which started casting effect on August shipment allocation.

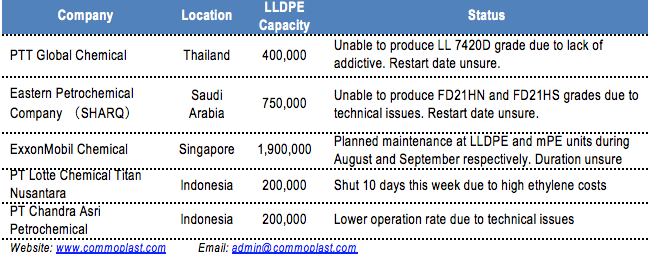

In fact, Thailand’s PTT has informed customers in both Southeast Asia and China about the lack of addictive used in producing LLDPE C4 film, Mi-2 which caused delays for previously transacted cargoes while no new allocation available for three weeks in a row now.

Meanwhile, Eastern Petrochemical Company (SHARQ) in an official email to Asian buyers late last week informed about a serious, prolong technical issue at one of its LLDPE lines that disrupt the production of LLDPE C4 film Mi-2 grade. “For cargoes purchased last month, we were informed that no shipment date has been set. We might have to seek for replacement materials,” a Vietnamese converter said while adding that no allocation for August shipment is available from the maker.

In the meantime, domestic LLDPE film market in Indonesia has been suffering from a shortage for nearly two months given the fact that both major local producers PT Lotte Chemical Titan Nusantara and PT Chandra Asri Petrochemical are unable to restore stable production rate. “Both producers are only able to fulfill contract orders while spot market is not receiving sufficient quantity,” a trader commented.

While most suppliers have blamed technical issues for the production disruption, sources are speculating that sellers would prefer to sell ethylene to producing LLDPE film given the big discrepancy in pricing. “Such action would taper supply going forward and might push import offers higher, especially the manufacturing season is just around the corner,” a regional buyer added.

In the meantime, Indian materials are widely available in both China and Southeast Asia in recent days at very attractive price levels. As a result, Asian buyers are not expecting any strong rebound, “Unless there is a serious delay in shipment for these cargoes,” another market source commented.

The effect of the tightening supply might be moderated by other macro factors such as the sharp depreciation of local currencies that make import more expensive and the lingering fear on the trade war.