SEA players: Import PET might be nearing the bottom, exchange rate in concern

SEA players: Import PET might be nearing the bottom, exchange rate in concern

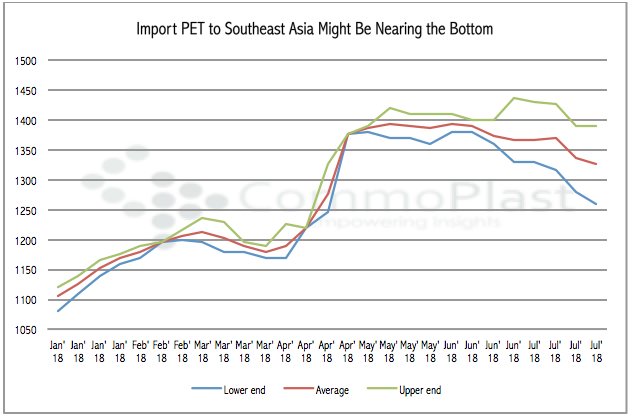

The Asian PET bottle market peak-out in early June after more than two months of sharp increases due to tightened supply amid high demand season. However, it is interesting that the lower end of the overall price range, which consists mostly of Chinese cargoes, witness a larger drop than the upper end, which represents non-dutiable sources. CommoPlast data indicates up to $120/ton reduction at the lower end from the second week of June.

The blame for the fall is put on the improving supply condition across the global market while demand is usually softer in the third quarter of the year. However, sources started discussing a possibility that market might be nearing the bottom as the manufacturing season during late quarter 3 might boost purchasing interest in August.

“We think prices might start to stabilize in the coming week and might regain some strength in August as manufacturers need to prepare for year-end orders,” a regional trader offered Chinese PET at $1260-1265/ton CIF Vietnam said.

The garment sector might also enter the high demand season soon as winter is just around the corner, sources said. “In the meantime, we are monitoring the impact of the recent fire at major Mexico’s PTA plant that supplies to various PET producers in Mexico and the USA. The event could result in lower operation rate at downstream PET producers,” another player added.

The expectation for a more stabilized condition is prevailing among suppliers at the moment; however, sources are more humble when looking at the upside of the near-term prospect. “The steep depreciation of the local currency is making imports more expensive. Demand for our end product is stable, but might adopt more cautious stance when it comes to fresh purchases,” an Indonesian buyer added.

Other regional buyers are hoping to see an additional reduction as a result of the constant appreciating of the US dollar recently. “The exchange rate is the main concern for now. We started receiving new orders for end-product, though might wait a couple of days more before committing to fresh replenishment,” a Vietnamese buyer received offers for Chinese material at $1255/ton CIF, added.